BFA has been developing its internal control structure to guarantee compliance with the existing existing regulations and the application of the policies of prevention of Money Laundering and the Financing of Terrorism.

BFA has implemented and promotes compliance with the principles regulated by the BNA and CMC and the Authorities with regard to the rules of Corporate Governance and Internal Controls and, in the latter, the rules of Compliance Risk management in its regulatory aspect and prevention of ML/FT. Additionally, in order to strengthen its system, it adopted and adapted a set of internationally recognised and accepted key concepts, namely the recommendations issued by the Basel Committee on Banking Supervision and by the Financial Action Task Force (FATF).

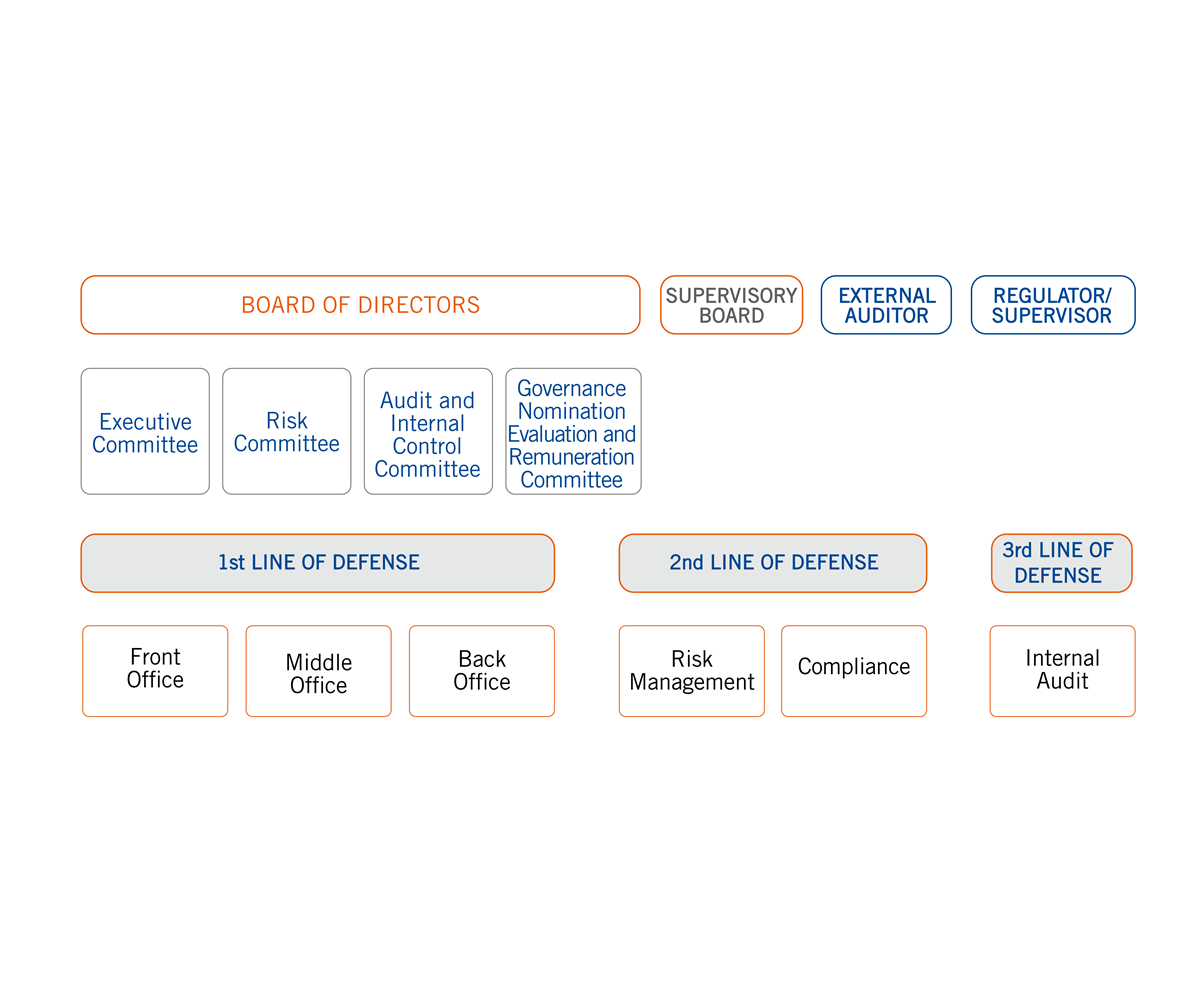

The governance model of the risk management system at BFA develops on two main levels:

Strategic: Competence of the Board of Directors, assisted by the Executive Committee and a wide range of specialised Committees, which are responsible for the follow-up, monitoring and risk controls.

Operational: Implementation of the three lines of defence model with clear responsibilities and risk management in a transversal manner.

The Internal Control System at BFA is based on the proper segregation of the three lines of defence:

Submetido com sucesso.

Foi enviado um código de confirmação para o seu email. Para concluir o processo deve guardar o código e dirigir-se a um balcão BFA.

Encontrar o balcão| EUR | 186,302 | 191,891 |